产品中心

Lorem Ipsum is simply dummy text

关于我们

Create value for partners!

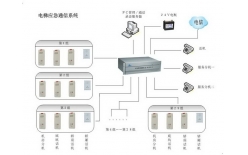

索泰通讯科技有限公司是集开发、销售为一体的通讯领域高科技企业,其主要产品有数字程控电话交换机,数字集团电话,数字程控调度机,电话交换机,集团电话,呼叫中心系统,电话录音系统,电话留言系统,监狱探视对讲,酒店管理软件等。部分产品获国家强制性CCC认证和信息产业部电信设备进网许可证。

索泰通讯科技有限公司拥有一支技术过硬的科技队伍,产品功能齐备,品质优良,处于国内领先水平。公司经过多年发展,经营规模不断扩大,赢得广泛的赞誉,产品销往全国各地及东南亚、非洲等地区。

索泰通讯科技有限公司实行现代企业管理制度,密切关注市场反馈,努力提供最完善的售后服务,在全国大部分城市设立有办事处及代理网点。

不断探索创新,泰然面对挑战 索泰,致力于奉献切实适合中国用户需求的通讯产品。

新闻资讯

Always pay attention to the industry trends

2023-06-28

JST5000电梯应急通信系统/电梯五方通话

2023-06-28

JST2000(T)型可扩容到96门

JST2000(T)型原来最大门数只能做到80门现在可以做到96门

2023-06-28

更新中。。。

2023-06-28

更新中。。。

解决方案

下载链接

Intelligent application